All Categories

Featured

Table of Contents

Policies can also last up until defined ages, which in the majority of situations are 65. Beyond this surface-level information, having a greater understanding of what these plans require will assist ensure you purchase a plan that meets your demands.

Be conscious that the term you select will affect the costs you spend for the policy. A 10-year degree term life insurance policy policy will cost less than a 30-year plan since there's much less opportunity of an event while the plan is energetic. Lower danger for the insurance provider corresponds to lower costs for the insurance policy holder.

Your family's age need to also affect your plan term selection. If you have little ones, a longer term makes good sense due to the fact that it shields them for a longer time. However, if your children are near the adult years and will be monetarily independent in the close to future, a shorter term could be a far better suitable for you than a prolonged one.

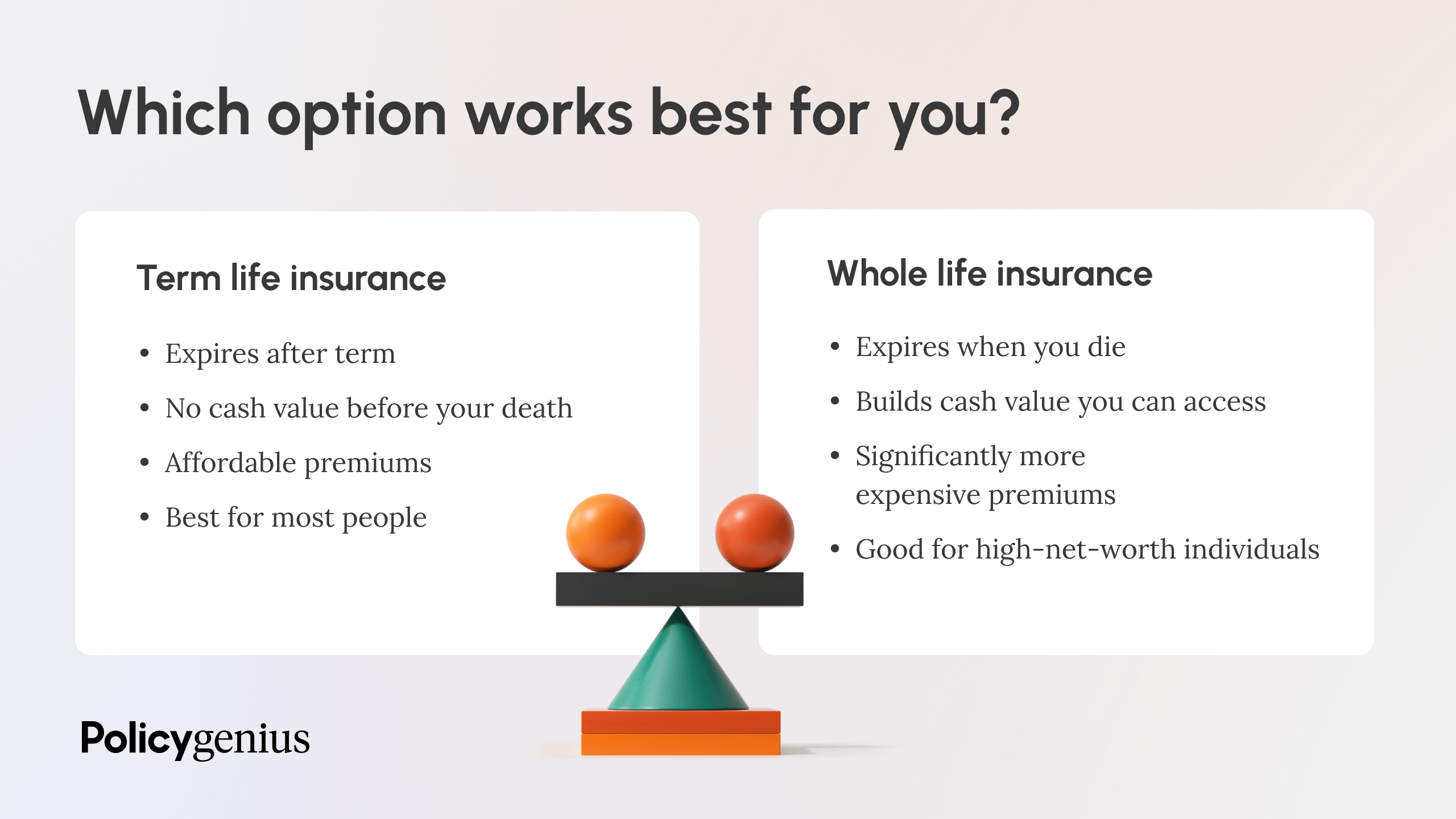

When contrasting entire life insurance coverage vs. term life insurance policy, it deserves keeping in mind that the last usually sets you back less than the former. The result is more insurance coverage with lower premiums, giving the very best of both worlds if you require a substantial quantity of insurance coverage but can not afford a more costly plan.

What is the Meaning of Term Life Insurance For Seniors?

A degree survivor benefit for a term policy usually pays out as a lump amount. When that happens, your beneficiaries will certainly obtain the entire amount in a solitary payment, and that amount is ruled out income by the IRS. Therefore, those life insurance proceeds aren't taxable. Some degree term life insurance policy companies enable fixed-period payments.

Rate of interest repayments got from life insurance coverage plans are taken into consideration revenue and are subject to taxes. When your level term life policy expires, a few different things can occur.

The downside is that your eco-friendly degree term life insurance coverage will come with greater premiums after its first expiration. Advertisements by Cash.

Life insurance policy business have a formula for determining threat utilizing death and rate of interest (term life insurance for seniors). Insurers have hundreds of customers obtaining term life plans at when and make use of the premiums from its energetic plans to pay enduring beneficiaries of various other policies. These business utilize death tables to estimate just how many people within a specific team will file death insurance claims each year, which info is used to identify ordinary life spans for potential policyholders

Additionally, insurance provider can spend the money they receive from premiums and raise their revenue. Considering that a level term plan does not have cash money worth, as an insurance policy holder, you can not spend these funds and they don't offer retirement income for you as they can with entire life insurance coverage policies. The insurance company can spend the cash and earn returns.

The following area information the pros and cons of level term life insurance coverage. Predictable costs and life insurance coverage Streamlined policy framework Possible for conversion to permanent life insurance policy Limited protection duration No money value accumulation Life insurance coverage premiums can boost after the term You'll find clear advantages when comparing level term life insurance policy to various other insurance policy types.

What is Level Premium Term Life Insurance Policies and Why Is It Important?

From the minute you take out a policy, your costs will certainly never alter, helping you prepare monetarily. Your coverage will not differ either, making these plans efficient for estate planning.

If you go this path, your premiums will increase yet it's constantly excellent to have some flexibility if you desire to maintain an energetic life insurance coverage policy. Sustainable degree term life insurance policy is one more option worth thinking about. These plans allow you to maintain your current strategy after expiry, supplying versatility in the future.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. business key person insurance agents. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

What is What Does Level Term Life Insurance Mean? Learn the Basics?

You'll pick an insurance coverage term with the best degree term life insurance coverage prices, yet you'll no longer have protection once the plan runs out. This downside might leave you clambering to find a new life insurance plan in your later years, or paying a premium to extend your current one.

Numerous entire, global and variable life insurance policy plans have a cash value component. With one of those plans, the insurance company deposits a portion of your month-to-month premium settlements right into a cash money worth account. This account gains passion or is spent, helping it grow and provide a much more substantial payment for your beneficiaries.

With a degree term life insurance policy policy, this is not the case as there is no cash worth element. Therefore, your policy won't expand, and your survivor benefit will never raise, therefore restricting the payout your beneficiaries will receive. If you want a policy that gives a survivor benefit and builds money value, check out whole, universal or variable strategies.

The 2nd your policy ends, you'll no more have life insurance protection. It's often feasible to restore your plan, yet you'll likely see your costs boost dramatically. This might present issues for retired people on a fixed income because it's an extra expense they may not be able to manage. Degree term and reducing life insurance policy deal similar plans, with the major difference being the death advantage.

It's a kind of cover you have for a specific quantity of time, called term life insurance policy. If you were to pass away while you're covered for (the term), your liked ones obtain a fixed payout agreed when you secure the plan. You simply choose the term and the cover quantity which you can base, for instance, on the cost of raising children until they leave home and you could utilize the payment in the direction of: Aiding to repay your mortgage, financial obligations, bank card or fundings Helping to pay for your funeral expenses Helping to pay university fees or wedding costs for your kids Assisting to pay living prices, replacing your revenue.

What Are the Benefits of Annual Renewable Term Life Insurance?

The plan has no cash worth so if your settlements quit, so does your cover. If you take out a degree term life insurance policy you can: Choose a fixed amount of 250,000 over a 25-year term.

Latest Posts

Final Expense Insurance Canada

United Burial Insurance

How To Sell Final Expense Insurance